Should Privately Insured Credit Unions get the Same Treatment as Federally Insured ones? (H.R. 299)

Do you support or oppose this bill?

What is H.R. 299?

(Updated December 26, 2017)

This bill would allow privately insured credit unions to become members of the Federal Home Loan Bank (FHLB) system without federal deposit insurance. This would be a reduction on the regulatory requirements expected of community credit unions — a reduction this bill hopes will improve the U.S. housing market.

"The FHLB system is a cooperative, government-sponsored enterprise made up of 12 regional banks that offer financing to almost 7,400 members (banks, thrift institutions, insurance companies, and credit unions). FHLBs make loans (known as “advances”) and provide other credit services that members use to fund mortgages and other loans. Consolidated assets of the FHLBs totaled $913 billion at the end of calendar year 2014, including about $570 billion in advances."

The state banking supervisor in charge of a privately insured credit union’s charter would decide whether or not a credit union is eligible for federal deposit insurance. If the state banking supervisor fails to make a decision within six months of an application, the credit union would be considered to have satisfied the requirements.

FHLBS would be able to give advances to state-chartered credit unions that aren't federally insured — with the same standing on their interest in collateral that secures the security interest — as if they were advancing a federally-insured credit union.

Within 18 months of this bill’s enactment, the Comptroller General of the U.S. would have to conduct a study on the adequacy of insurance reserves held by a private deposit insurers that cover deposits made in a state-chartered credit unions. The study would also cover a private deposit insurers’ level of compliance with federal disclosure requirements, and would be delivered to Congress on its completion.

Argument in favor

This bill would help members of private credit unions gain greater access to credit in a tight market. Plus, state banking regulators would ensure that privately insured credit unions have adequate risk protections in place.

Argument opposed

Risk concerns: privately insured credit unions are not subject to federal examinations. Relying on state regulators to provide oversight seems risky, and the number of credit unions that would be affected is small.

Impact

Privately insured credit unions and their customers, member-owned credit unions, federal home loan banks, the Comptroller General, and the U.S. housing market.

Cost of H.R. 299

A CBO cost estimate is unavailable.

Additional Info

In-Depth:

A version of this bill was passed by the House in May 2014 on a 395-0 vote, but it stalled in committee in the Senate. In a memo sent out to members of the House, Majority Leader Rep. Kevin McCarthy (R-CA) wrote of this bill and others on the schedule for the week of Apr. 13, 2015 :

"We will begin this month with a series of bills aimed at getting the government off the backs of taxpayers and reforming the institutions that serve them. First up will be a series of bills to promote a healthier economy, preserve consumer choice and help our fellow Americans achieve the dream of financial independence."

Of Note:

H.R. 299 would permit state-chartered, to become members of the FHLB system. Under current law, privately insured credit unions can only get into the FHLB system if they are also "community development financial institutions." The CBO cost estimate of this bill cites information from the National Credit Union Administration that found: "there are about 130 privately insured credit unions holding about $14 billion in assets that would become eligible for membership under the bill."

There are over 2,500 state-chartered credit unions in the U.S., and 95 percent of those credit unions have federally-backed deposit insurance, while about 130 of them have private deposit insurance.

Media:

Sponsoring Rep. Steve Stivers (R-OH) Press Release

Credit Union Times (Previous Bill Version)

Wikipedia (Previous Bill Version)

The Hill (Previous Bill Version)

National Association of State Credit Union Supervisors (Context)

Credit Union National Association (In Favor)

The Latest

-

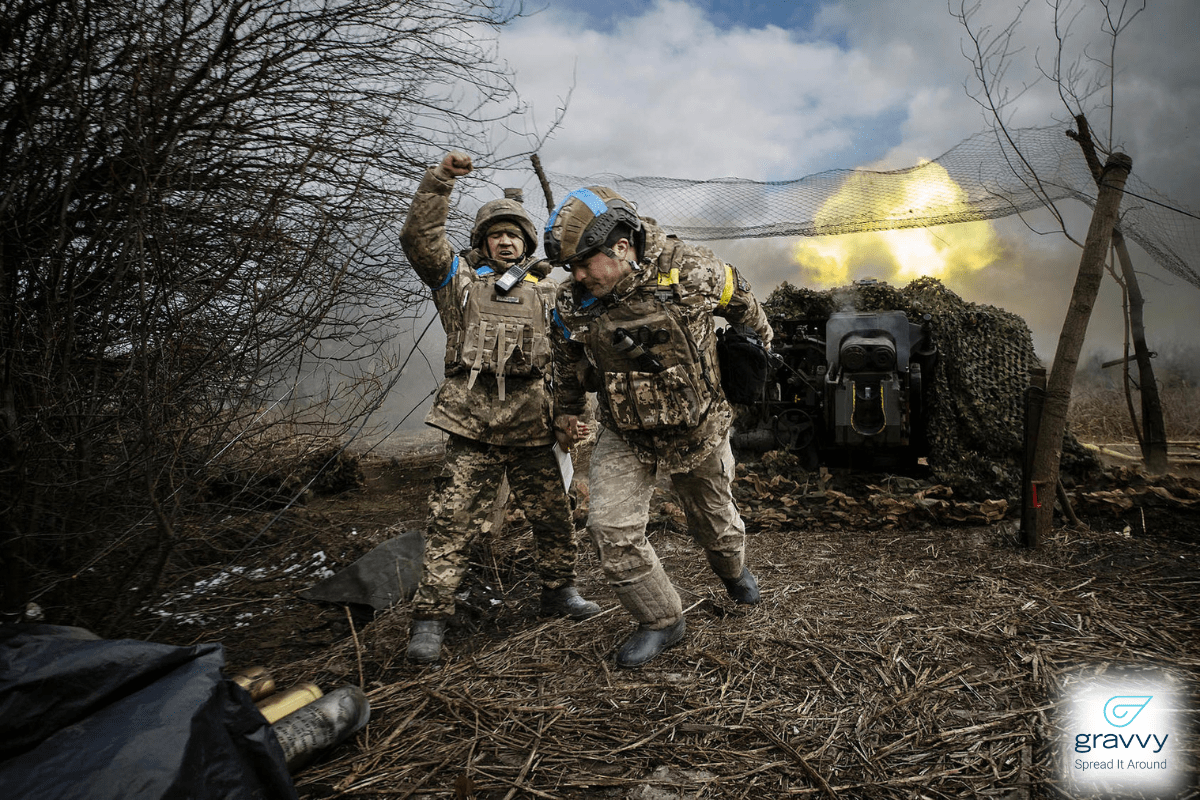

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety -

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel -

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement -

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security