Should the SEC Study Potential Changes to an Insider Trading Rule? (H.R. 624)

Do you support or oppose this bill?

What is H.R. 624?

(Updated April 14, 2019)

This bill would require the Securities and Exchange Commission (SEC) to study and potentially amend Rule 10b5-1 to ensure that corporate insiders are unable to indirectly engage in illegal insider trading through changes to their trading plans.

Specifically, the SEC would be required to examine the impact of the following changes to 10b5-1 rules:

Limits on creating 10b5-1 trading plans during insider trading windows;

Prohibiting multiple, overlapping 10b5-1 plans;

Implementing a mandatory delay between the adoption of the plan and the first trade;

Creating rules as to the frequency with which insiders may adopt, modify, or cancel plans;

Requiring insiders to file trading plan adoptions, amendments, terminations, and transactions with the SEC; and

Requiring board oversight of 10b5-1 plans, including corporate policies, adoption, and monitoring.

Argument in favor

Insider trading is a serious crime that makes the market unfair for investors who don’t have inside knowledge of companies’ operations. Trades allowed under the rule in question need to be closely monitored and subject to rules that ensure executives and insiders can’t use their knowledge of companies’ operations to engage in insider trading.

Argument opposed

When properly administered, plans under the rule in question are important investment tools for executives and other insiders to trade stocks. While bad investors will occasionally engage in improper trades, it’d be an overreaction to curtail these plans due to a few bad actors.

Impact

Executives; insiders; stock trading; the SEC; and Rule 10b5-1.

Cost of H.R. 624

When this bill was introduced in the 115th Congress, the CBO estimated that implementing it would cost around $1 million for the SEC to conduct the required studies and rulemakings and issue reports.

Additional Info

In-Depth: Rep. Maxine Waters (D-CA) reintroduced this bill to direct the SEC to study how to amend Rule 10b5-1 to ensure that corporate insiders can’t indirectly engage in illegal insider trading:

"I am happy to work with Ranking Member McHenry on the first of what I hope will be many bipartisan bills to strengthen consumer and investor protections in the 116th Congress. Our bill, the Promoting Transparent Standards for Corporate Insiders Act, will play a critical role in holding corporate executives accountable and improving SEC Rule 10b5-1, which currently allows corporate insiders to avoid accusations of illegal insider trading. It would require the SEC to study how to amend its rule to address reported incidents of manipulation, report to Congress, and write rules consistent with the results of the study. It should be a top priority for regulators to ensure clear guidelines and robust enforcement of illicit activities, such as insider trading, and this legislation will serve as a driving force to hold regulators and bad actors accountable."

When he and Rep. Waters reintroduced this bill in the current Congress, Rep. Patrick McHenry (R-NC) said:

“Cracking down on fraud and abuse within our financial system is apolitical. I am proud to support this meaningful effort to help the SEC better understand illicit insider trading. I look forward to working with Chairwoman Waters, and the Financial Services Committee as a whole, to explore ways to improve federal government oversight and protect American investors.”

Americans for Financial Reform (AFR) and the Consumer Federation of America (CFA) wrote a letter to Congress in July 2018 supporting this bill in the 115th Congress:

“This [bill] is especially timely given the multi-trillion dollar wave of company share buybacks that have been occurring in the current low interest rate environment and in response to the enormous corporate tax cuts recently passed by Congress. Insiders can make large profits by selling directly into such share buybacks. The combination of share buybacks and insider trading represents a direct diversion of corporate revenues from investment in the broader economy to private payments for top executives. It constitutes a major incentive for corporate decision makers to inappropriately favor share buybacks over other uses of funds such as investment and hiring. Evidence has been available for many years that corporate executives take advantage of their knowledge of buyback plans to make additional profits selling their own stock. This evidence was recently summarized by SEC Commissioner Robert Jackson. It appears that the SEC’s current rule 10b5-1 facilitates such profiteering by providing an overly broad safe harbor against insider trading prohibitions. Over the past five years the Council of Institutional Investors (CII) has repeatedly urged the SEC to take action to prevent these abuses. This bill would require the SEC to study whether Rule 10b5-1 is providing adequate protection against insider trading and whether it should be changed in accordance with the recommendations of the CII. The specificity of the directives for this study should be useful in driving action by the SEC. We urge the Committee to pass this bill.”

The American Bar Association acknowledges that rule 10b5-1 trading plans can increase an insider’s liability risk, but also points that properly structured and administered rule 10b5-1 trading plans are a safe and effective way for insiders to trade:

“When used improperly, Rule 10b5-1 trading plans can increase an insider's liability risk, such as where trades occur too soon after the adoption of a plan, where plans are repeatedly adopted and terminated or where the insider supplements a plan with non-plan trades, each of which may suggest that the insider attempted to take advantage of material nonpublic information. But when structured and administered properly, Rule 10b5-1 trading plans can provide a safe and effective way for insiders to trade.”

In the current session of Congress, this bill has one cosponsor, Rep. Patrick McHenry (R-NC), as well as the support of the Council of Institutional Investors (CII) and Public Citizen. Last Congress, this bill was part of a bipartisan economic growth bill, the JOBS Act 3.0, which the House passed on a 406-4 vote. This bill had one cosponsor, Rep. Patrick McHenry (R-NC).

Of Note: Rule 10b5-1 of the Securities Exchange Act of 1934 allows officers, directors and other insiders of public companies to purchase and sell their company's stock while they are in possession of material nonpublic information, provided that the transaction is made pursuant to a trading plan previously established at a time when the insider was not aware of material non-public information. Bipartisan political scrutiny of executive 10b5-1 plans increased over the 2017-2018 period due to the timing of some 10b5-1 stock trades relative to the internal discovery and/or public announcement of major scandals by multiple companies, including Intel and Equifax.

Critics of rule 10b5-1 have long viewed it as creating an opportunity for abuse, as insiders may be aware of material nonpublic information at the time plans are established, and the rule can be used to provide cover for improper trades.

Media:

-

House Committee on Financial Services Press Release (116th Congress)

-

Sponsoring Rep. Maxine Waters (D-CA) Statement at Bipartisan Committee Markup (115th Congress)

-

CBO Cost Estimate (115th Congress)

-

Americans for Financial Reform (AFR) and Consumer Federation of America (CFA) Letter to Congress (In Favor, 115th Congress)

-

Council of Institutional Investors (CII) Letter to Congress (In Favor, 115th Congress)

-

ThinkAdvisor

-

American Bar Association (ABA) (Context)

-

Vox (Context)

Summary by Lorelei Yang

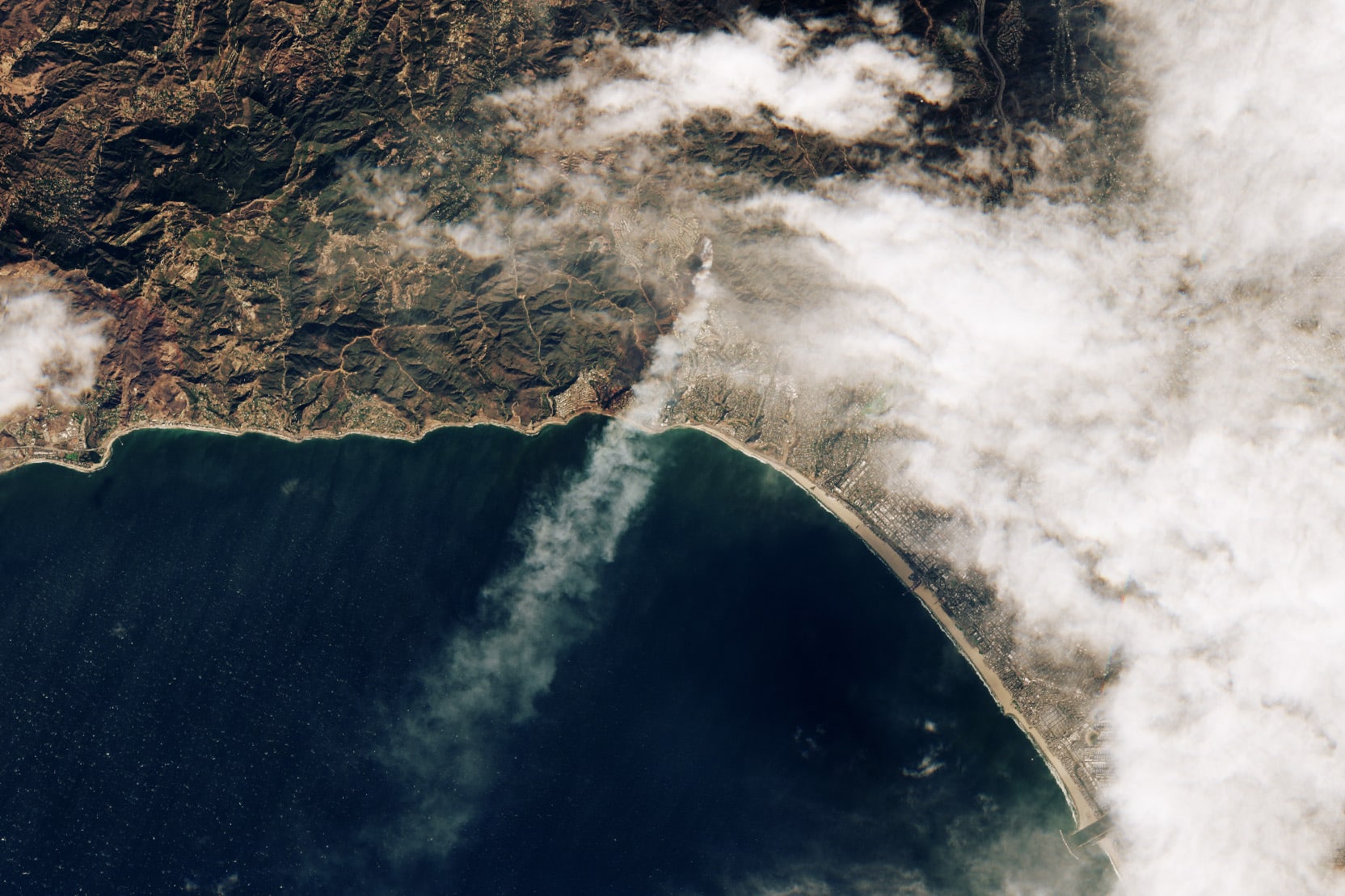

(Photo Credit: iStockphoto.com / gopixa)

The Latest

-

Changes are almost here!It's almost time for Causes bold new look—and a bigger mission. We’ve reimagined the experience to better connect people with read more...

Changes are almost here!It's almost time for Causes bold new look—and a bigger mission. We’ve reimagined the experience to better connect people with read more... -

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy -

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment -

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... Families

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... Families

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security