Does Congress Need to Oppose a Carbon Tax? (H. Con. Res. 89)

Do you support or oppose this bill?

What is H. Con. Res. 89?

(Updated December 10, 2020)

This resolution would express Congress’ opposition to a federal carbon tax due to concerns that it would raise prices on essentials like food, gasoline, and electricity while having a negative impact on U.S. economic growth. In general, a carbon tax seeks to reduce emissions by taxing carbon-based fossil fuels like coal, oil, or natural gas at a given stage of the fuel’s product lifecycle.

While there are no impending votes on legislation that would impose a carbon tax, the lawmakers supporting this resolution outlined their specific concerns that such a policy:

Would impact the budgets of families and consumers across the board through higher prices, but would especially harm the poor, the elderly, and those on fixed incomes;

Would increase the cost of all goods manufactured in the U.S. while restricting the global competitiveness of America’s economy;

Would restrict domestic energy production and inhibit or reverse the job creation and investment that the energy industry has contributed to the U.S. economy.

As a concurrent resolution, this legislation could be passed by both chambers of Congress, but it wouldn’t go to the president’s desk for a signature as it wouldn’t have the force of law.

Argument in favor

Lawmakers need to call out bad ideas and stand against them before they gain traction. There are valid concerns that imposing a carbon tax would raise prices for consumers and hurt the U.S. economy as a result.

Argument opposed

Congress shouldn’t waste its time expressing opposition to a proposal that isn’t being seriously advanced at this point in time anyway. Besides, a carbon tax is a good idea and would help the U.S. deal with climate change.

Impact

Americans who would be affected by a carbon tax; lawmakers that support a carbon tax; and Congress.

Cost of H. Con. Res. 89

A CBO cost estimate is unavailable.

Additional Info

In-Depth: Sponsoring Rep. Steve Scalise (R-LA) introduced this resolution to give Congress an opportunity to stand against suggestions that the U.S. should adopt a carbon tax, as he believes such a tax would be detrimental to the economy:

“A national energy tax would force Americans to pay higher prices for goods and services of all kinds. It would mean higher electricity bills, increased prices at the pump, and fewer jobs for hard-working taxpayers.”

Proponents of a carbon tax argue that dealing with climate change will be a costly endeavor no matter what, and that it could be a more efficient way of reducing emissions. Rep. Don Beyer (D-VA) has advocated for a carbon tax since his election in 2014, and thinks it could still have a future:

“Republicans tend to hate regulations, especially the president’s new power plants rules. And yet, putting a carrbon tax in place could, in many ways, be a more efficient way to accomplish these goals, and with more flexibility.”

Of Note: Back in August 2013 the House passed legislation that would have prevented the White House from imposing a carbon tax without congressional approval, but it failed to receive a vote in the Senate before the end of the 113th Congress.

There is no federal carbon tax on the books in the U.S., although such taxes have been implemented to a limited degree at the state and local level.

Media:

- Sponsoring Rep. Steve Scalise (R-LA) Press Release

- The Hill

- Washington Examiner

- Center on Budget and Policy Priorities (Opposed)

- Heartland Institute (In Favor)

(Photo Credit: Flickr user Prayitno / Thank You for (10 millions +) views)

The Latest

-

IT: Trump's 2016 'deny, deny, deny' campaign strategy, and... How can you help the civilians of Ukraine?Welcome to Wednesday, May 8th, weekenders... As Trump's hush money trial enters it's third week, the 2016 campaign strategy of read more...

IT: Trump's 2016 'deny, deny, deny' campaign strategy, and... How can you help the civilians of Ukraine?Welcome to Wednesday, May 8th, weekenders... As Trump's hush money trial enters it's third week, the 2016 campaign strategy of read more... -

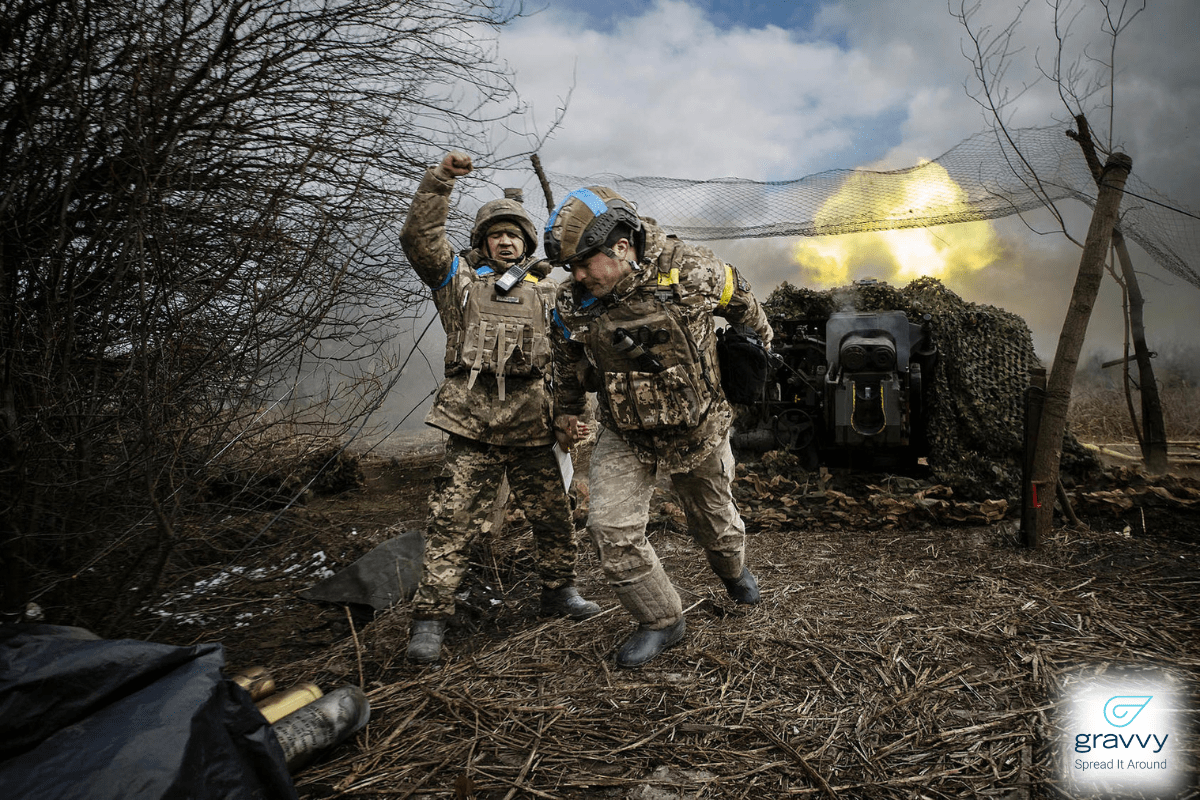

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety -

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel -

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security